Gold Flashing Crisis Signal? Why Investors Shouldn’t Panic (Yet)

If you’re an investor looking for a glimmer of hope in this miserable market, you’ve found it with gold.

So far in 2025, gold prices have surged more than 30%, hitting new highs above $3,400 an ounce. It’s one of the sharpest, fastest rallies in gold’s history

Unfortunately, it’s also a strong warning sign.

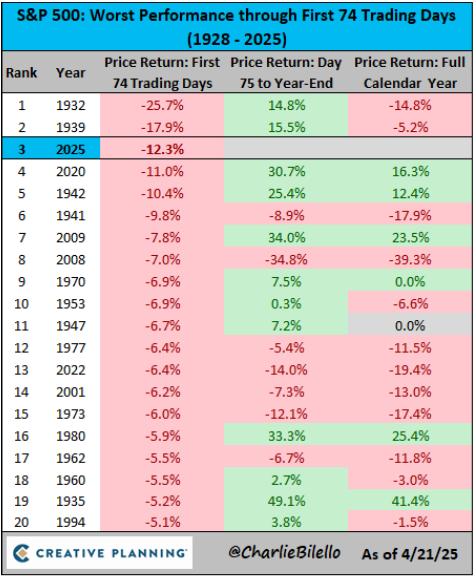

Here’s the deal: 2025 has been ugly for stocks. In fact, through the first 74 trading days of the year, the S&P 500 is down more than 12%. That makes this the third-worst start to a year on record. The only years that were worse were two during the Great Depression – 1932 and ‘39. And the only years with comparably bad starts? 1941 and ’42 (mid-World War II), 2008 and ‘09 (great financial crisis), and 2020 (COVID-19 pandemic).

When you’re brushing shoulders with those chapters of history, you know things aren’t going well.

But while stocks are getting steamrolled, gold is enjoying a ‘golden hour.’ Not just good – we’re talking parabolic, headline-dominating, all-time-highs kind of performance.

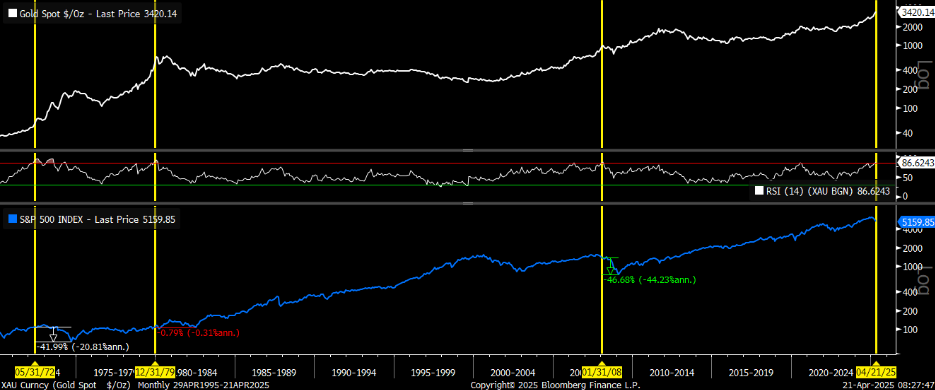

Technically speaking, it’s one of the most overbought gold markets we’ve ever seen; and that provides an important signal for stocks.

How Overbought Is Gold in 2025? The RSI Tells a Warning Story

How extreme is this move?

Gold’s relative strength index (RSI) – a momentum indicator used to measure how overbought or oversold an asset is – just jumped above 85 on a monthly basis.

Let’s put that in context: any reading above 70 is considered overbought. So, above 85? That’s so hot it may as well be molten lava.

In the past 55 years, gold has only gotten this hot three times before:

- In 1972, just after Nixon implemented price controls and strong-armed the Federal Reserve into cutting rates (and right before a decade of hyperinflation).

- In December 1979, when then-Fed Board Chair Volcker began hiking rates aggressively to crush hyperinflation.

- And in January 2008, as the U.S. housing market was imploding into the great financial crisis.

These weren’t minor market pullbacks. They were turning points in economic history.

Every Time Gold Surged Like This, Stocks Tanked…

Spoiler: Gold’s outperformance was like a kiss of death for stocks.

After the 1972 gold surge, the stock market fell ~40% over the next two years. After 1979’s peak, stocks went nowhere for three straight years. And following the early 2008 spike, stocks crashed 45% over the following 12 months.

Every time gold has reached this level of being technically overbought, stocks have gone into hibernation – or worse.

Gold gets this hot when fear rules the market. And when fear rules, it’s usually because something very real and very bad is brewing in the background.

So, gold ripping this hard is a signal… and not a positive one.

Why Investors Are Flocking to Gold in 2025

Given today’s political and economic climate, gold’s rally makes perfect sense.

The White House has declared what can only be described as an economic world war, launching tariffs against nearly every major trading partner and threatening the entire post-WWII global trade framework. The markets are confused. Corporations and investors alike are spooked.

In that kind of environment, buying gold is like hiding in a panic room. It doesn’t pay dividends, innovate, or grow… but it doesn’t go bankrupt either.

It just sits there, safely, while the world burns. So, people buy it in preparation for such a catastrophe.

Now, this is where things get tricky – and interesting.

Yes, gold is flashing a warning sign. And yes, the last three times it flashed this bright, stocks suffered.

But we don’t think it’s time to panic. Despite the similarities to historical precedent, we believe this time is different.

The core drivers behind this gold surge aren’t structural or systemic. They’re not tied to broken banks, runaway inflation, or energy shocks.

Instead, they are the result of policy chaos — more specifically, a White House that’s cornered itself into a strategy that it now needs to walk back.

In other words, gold is up because of self-induced uncertainty. And uncertainty, unlike inflation or recession, can go away fast if the right headlines hit.

Trade Peace Could Flip the Script and Revive Stocks

We believe pressure is building around the Trump administration to cool its trade rhetoric and deliver some tangible wins.

The 90-day pause on Trump’s “Liberation Day” tariffs was sold as a fast-track toward dealmaking. But here we are, weeks later, and not a single deal has been signed. The clock is ticking, while investor confidence is draining.

If the White House doesn’t deliver real progress soon, markets could break further.

But if it does ink deals, then the narrative should shift fast.

- Trade deals = reduced global friction

- Reduced friction = reduced inflation risk

- Reduced inflation risk = Fed rate cuts

- Fed rate cuts = equity rally

All of a sudden, gold feels less necessary… and stocks become much more attractive.

Why Gold’s 2025 Rally May Not Mean Disaster for Stocks

We get it. “This time is different” are the four most dangerous words in investing.

But hear us out.

In the lead-up to the 1972 election, President Nixon pressured Fed Chair Arthur Burns to keep interest rates low to stimulate the economy – and boost his reelection chances. This political interference undermined the Fed’s independence and credibility, setting the stage for the inevitable inflationary surge that followed.

In 1979, inflation was already out of control. It surged into the double digits, driven by soaring oil prices, loose monetary policy, and a crisis of confidence in the U.S. dollar. Fed Chair Paul Volcker had to respond with aggressive rate hikes, pushing the federal funds rate above 20% in an effort to break the inflationary spiral.

And in 2008, the financial system was sitting on a ticking time bomb of bad debt. This was the result of years of aggressive lending practices, particularly in the subprime mortgage market, where banks extended loans to borrowers with poor credit. These risky mortgages were then bundled into complex financial instruments and sold to investors, creating a fragile house of cards that began to collapse when home prices fell.

None of that is true today.

- The Fed is not artificially cutting rates yet and, instead, is being very strategic and purposeful with its cuts – despite pressure from Trump to do so.

- Inflation is not spiraling out of control. The data continues to reflect a cooling trend; core CPI edged up 0.1% in March, below market expectations for a 0.3% increase. And overall CPI saw a decrease of 0.1% on a month-over-month basis, marking its first decline since May 2020.

- The banking system is not melting down. Balance sheets are strong. Many big banks just reported first-quarter earnings, with JPMorgan Chase (JPM) achieving record annual profits and Bank of America (BAC) seeing its revenue increase by 6% year-over-year to reach $27.4 billion.

- Employment remains resilient. Data from the Bureau of Labor Statistics shows that despite the unemployment rate edging up to 4.2% in March after being 4.1% in February, it remains in the range of 4.0% to 4.2% that it’s held since May 2024.

What we have here is not an economic death spiral – it’s an anxiety spiral. And anxiety can be soothed just as quickly as it forms.

From Panic to Profit: A Buy-the-Dip Moment for Stocks?

If and when this policy panic clears – and we think it will – gold will likely cool. And stocks will be primed for a V-shaped recovery.

That’s why, as contrarian as it might sound, we think this is a moment to go long stocks.

Specifically, we’re thinking high-beta tech, small caps, risk assets – the stuff that gets crushed when fear dominates… and flies when relief hits.

The last three times gold got this hot, stocks tanked. But this time might just be the time that breaks the pattern.

While gold’s record-setting rally is historic – and yes, historically, it has meant very bad news for stocks – context matters.

We believe this particular surge is being driven not by systemic collapse or runaway inflation but policy volatility. And that’s something that can turn on a dime.

So, no, we’re not ignoring this warning sign. But we’re not running for the hills either.

We’re watching and waiting. And when the clouds clear – when the trade war cools and the Fed starts cutting – we plan to go all-in on the rebound.

And the smartest AI investments may lie in what’s coming next: AI 2.0.

We’re talking about intelligent systems that can navigate the real world: machines that see, hear, move, speak, adapt, and even solve problems on the fly.

It’s no coincidence that the biggest names in tech are racing to develop these humanoid robots.

This is where we see the next wave of trillion-dollar opportunities taking shape – and we’ve identified a standout way to tap into this emerging phase of the AI revolution.

Get the full story on our top AI 2.0 stock pick.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at [email protected].